Outlier detection and imputation of missing data in stock related time series mulitivariate data using LSTM autoencoder

DOI:

https://doi.org/10.62110/sciencein.jist.2024.v12.761Keywords:

Deep Learning, Feature Extraction, Stock Market, Machine LearningAbstract

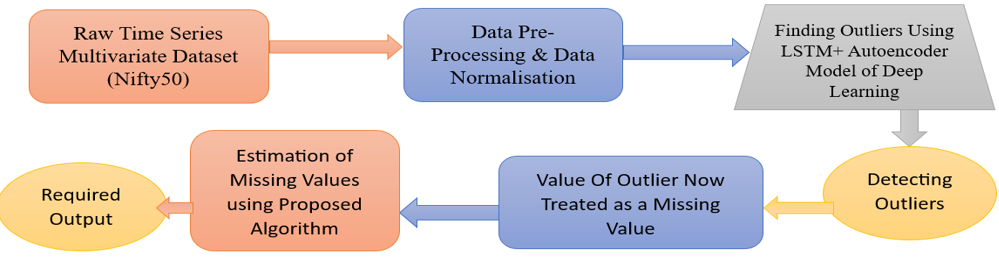

Incomplete data is a well-known problem with large databases, which raises challenges for many data mining applications. The main focus will be on developing scalable and adaptable anomaly detection techniques that can spot unusual trade patterns in vast amount of stock related data. In the designed method, an autoencoder based unsupervised outlier detection for multivariate time series data has been trained within a Long Short Term Memory Model, shaped by deep learning networks. Further, we also estimated value of outlier which is treated as missing value in dataset using our designed algorithm. The suggested method demonstrates the value of feature selection and data preparation for creating effective techniques for data modeling. Deep learning models can be tuned very little to produce good results. Our work used the Stock related dataset, that many investors choose due to its high risk, high reward, and flexible trading. In comparison, our designed work also examines the statistics and machine learning models in related application fields.

URN:NBN:sciencein.jist.2024.v12.761

Downloads

Downloads

Published

Issue

Section

URN

License

Copyright (c) 2023 Swati Jain, Naveen Chaudhary, Kalpana Jain

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Rights and Permission